Is It Possible I Could Outlive My Savings?

By Chris Dixon, Oxford Advisory Group

A: Yes — it’s possible to outlive your savings, especially with retirees living longer than ever before. But careful income planning and ongoing strategy reviews can help aim to make your money last throughout retirement.

The Growing Risk of Longevity

Many Florida retirees today live well into their 80s and 90s. That means your retirement savings might need to last 25–30 years — sometimes longer than your entire career. This creates what planners call longevity risk: the risk of running out of money too soon.

Why the “4% Rule” Doesn’t Always Work

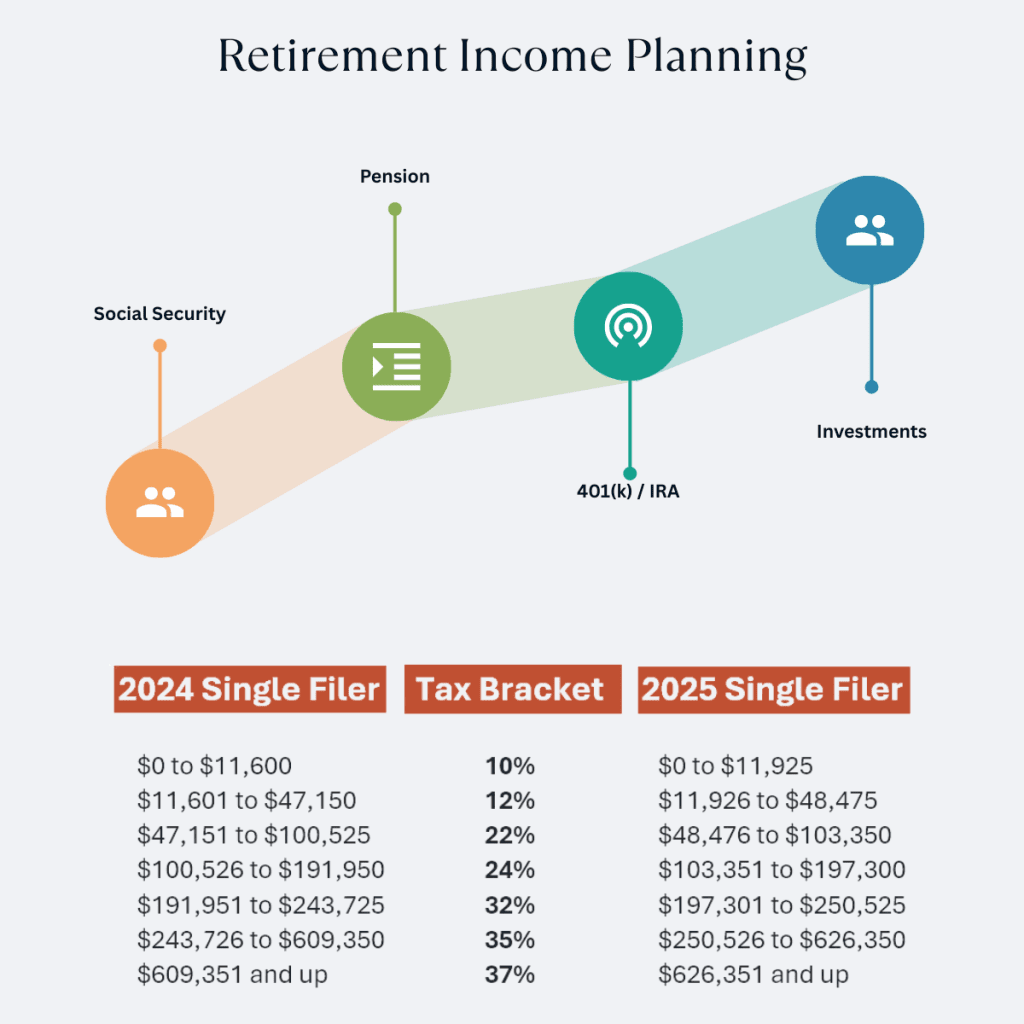

The old 4% rule — withdrawing 4% annually from savings — was built on past market conditions. Today, market volatility, inflation, and taxes could make that rule less reliable. A dynamic withdrawal plan based on your actual needs and tax efficiency may better serve your planning. Income plans that account for taxes are often a great first step in better understanding the longevity of your retirement assets.

Creating Income Designed to Last

At Oxford Advisory Group, we aim to help retirees across Jacksonville, Lakeland, and the greater Florida area build retirement income strategies designed to better align essential expenses with predictable income sources. This approach seeks to provide stability even when markets fluctuate.

Review and Adjust Regularly

The best retirement plans are living documents. Annual reviews allow you to adjust withdrawals, rebalance assets, and adapt to new tax laws or life changes. Consistent oversight can help extend the longevity of your portfolio.

Key Takeaway

Outliving your savings is a real concern, but not an inevitable one. A flexible, monitored income plan helps you adapt to life’s changes — and stay confident in your financial future.

Can I Outlive My Savings? Tax may be a factor.

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.